The Natural Gas Supply Association (NGSA) and Energy Ventures Analysis (EVA) released the Natural Gas Market Outlook report for Winter 2021-2022. Highlights include forecasts for gas production, Canadian gas imports, power burns and economical switching, industrial demand, LNG exports, Mexican gas exports, and end-of-winter season storage scenario analysis.

U.S. natural gas market became significantly tighter this past summer. Improved fundamentals and escalated supply concerns during the hurricane season sent September Henry Hub prices to the highest seasonal level in a decade.

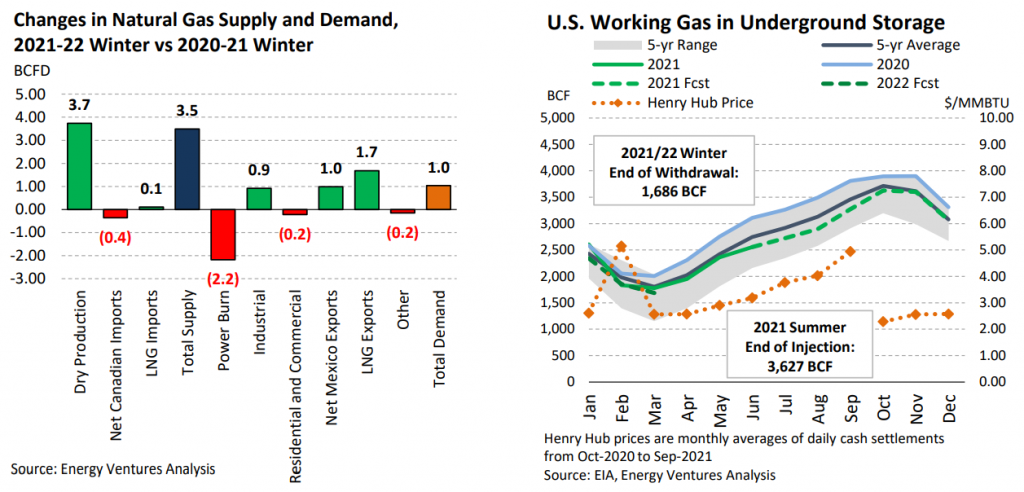

Driven by a tighter supply/demand balance, EVA expects the 2021 summer-end U.S. working gas storage to close at 3,627 BCF. If actualized, this level would be around 88 BCF below the five-year average.

On the demand side of the ledger, expanded U.S. LNG exporting capacity and improved Mexican downstream pipeline utilization have resulted in a material increase in export volumes. Domestically, natural gas consumption has remained resilient despite higher prices relative to the low prices of the last winter. In addition, record low water levels for hydroelectric generation in the West and a busier schedule of nuclear maintenance have all lent support to power burn over the past several months.

To access the executive summary of the report, please follow the link.