Donald Trump’s return to the White House has triggered a significant shift in U.S. energy policy, with offshore wind facing its biggest challenge yet. A recent executive order (EO), published on January 20, 2025, halting leasing of federal land and waters for wind energy projects, has injected uncertainty into the sector, delaying key projects, discouraging investment, and raising concern about the U.S.’s clean energy targets.

While the administration frames this move as a temporary pause to review permitting and leasing processes, the EO’s long-term implications could reshape the future of both onshore and offshore wind development. Some projects will continue moving forward, while others, particularly those still in early development, face significant hurdles that could delay or derail their progress.

Onshore Wind: Uncertain but Minimally Affected

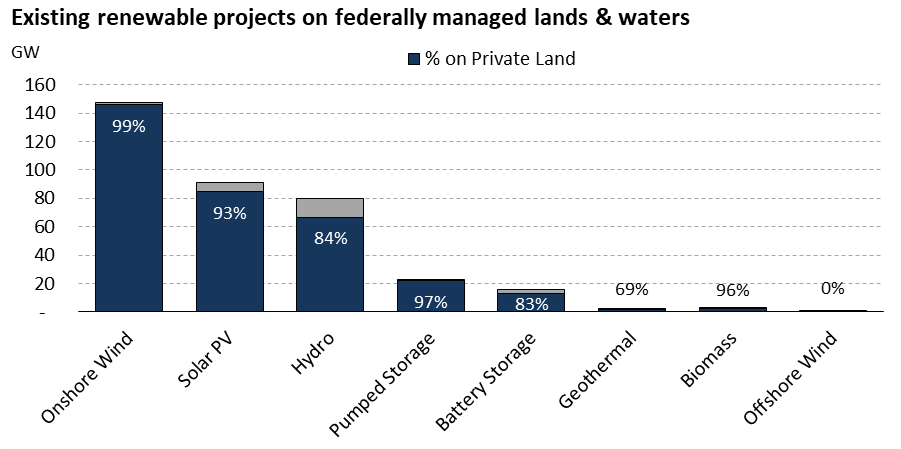

The EO suspends new federal permits, rights of way, leases, and loans for onshore wind projects until a federal review is completed. Additionally, permitting renewable energy projects on public lands faces a 60-day suspension, as per Department of Interior Order 3415, also issued on January 20, 2025. The impact of the DOI Order is expected to stay minimal for other mature renewable energy technologies like onshore wind, solar, battery, and hydro, as most of these projects are already developed outside federally managed lands. According to EVA’s analysis, 99% of operational onshore wind, 93% of solar PV, and 83% of battery storage capacity exist on non-federal (i.e., private) lands, indicating that these industries are less dependent on federal leasing. However, offshore wind, which is entirely reliant on federal waters (100%), faces the most significant risk. The moratorium on new leasing and permitting could halt planned offshore wind expansion, delaying projects, discouraging investment, and challenging the clean energy goals for states planning for significant growth in their offshore wind project portfolio.

Approximately twelve renewable energy projects in the permitting stage are currently on hold, including Idaho’s Lava Ridge wind project, which was already facing scrutiny over cultural and environmental concerns. This pause adds uncertainty to the wind industry, where growth has already slowed—new onshore wind capacity additions dropped to 4.6 GW in 2024, down from 6.5 GW in 2023 and 9 GW in 2022. While federal land projects make up a smaller share of overall development, the new leasing and permitting restrictions could further impact future growth.

Offshore Wind: The Real Target

In the final days of the Biden Administration, the nation reached 19 GW of approved offshore wind capacity. Moreover, under the administration, the 130 MW South Fork Wind project became the country’s second utility-scale offshore wind farm in April 2024 after the 40 MW Block Island wind farm off the Rhode Island coast. However, the Trump Administration’s EO has paused progress by halting new leasing on the outer continental shelf and freezing permitting for seven offshore wind projects and several others in early development.

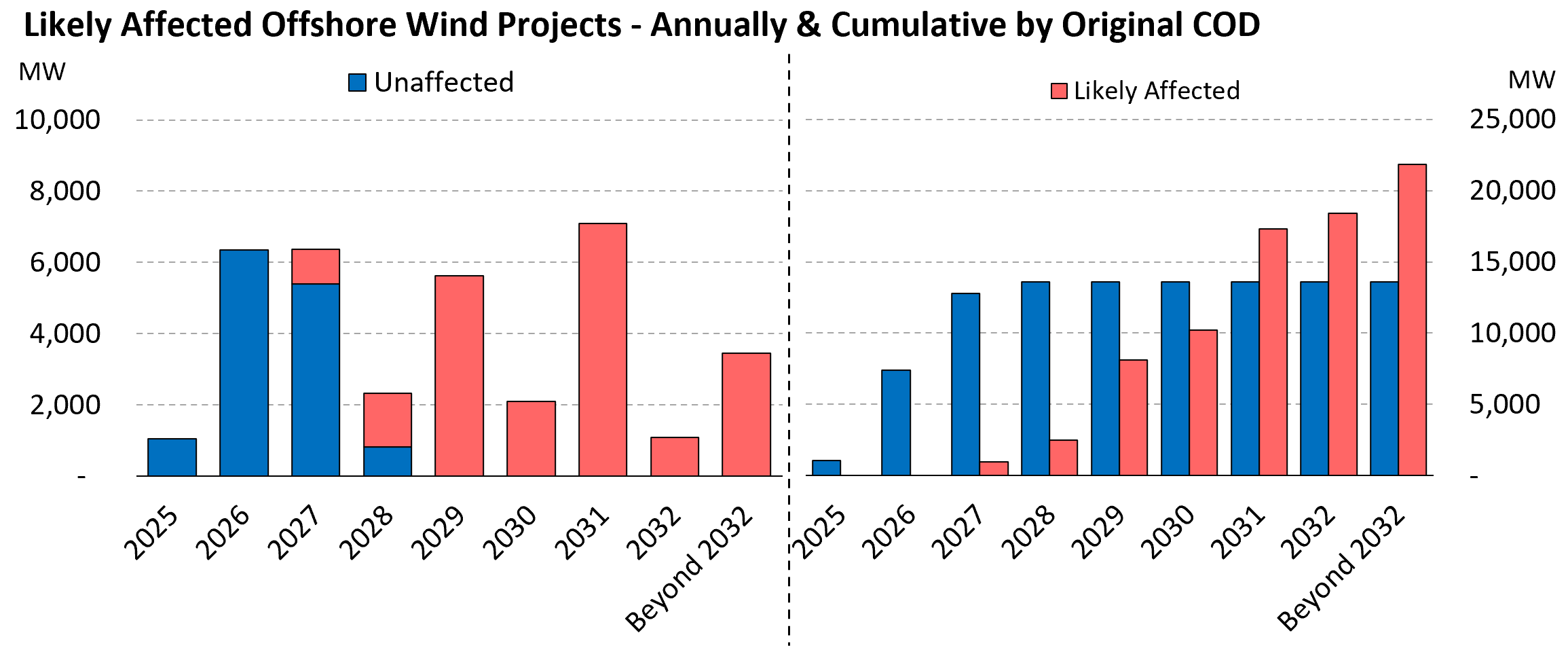

Despite this, nine commercial-scale offshore wind projects with federal permits remain unaffected, five of which are already under construction from Maryland to Massachusetts. Collectively, these projects represent nearly 14 GW (detailed table can be found at the end of this post).

Moreover, the executive order halting federal leasing threatens the U.S. offshore wind pipeline, putting upcoming lease sales—such as Gulf of Mexico 3 (2025) and Central Atlantic 2 (2026)—at risk. With major lease sales planned for New York Bight, California, and Hawaii through 2028, this policy shift could stall industry growth, disrupt investment, and undermine state-level clean energy targets.

A Two-Tier Industry

The executive order has created a two-tier industry: projects with issued federal permits, like Vineyard Wind 1, Revolution Wind, and Coastal Virginia Offshore Wind, continue as planned, while others still working through their permitting process, such as South Coast Wind (2,400 MW) and Attentive Energy Two (1,400 MW), now face notable delays. Meanwhile, pre-permitting projects, including Kitty Hawk South (2,500 MW) and Beacon Wind 1 & 2 (1,230 MW), are the most vulnerable.

State-Level Impacts

Certain states face disproportionate challenges. In New Jersey, three of four major projects—including Ocean Wind 1 & 2—are delayed, while only Atlantic Shores South (2.8 GW) remains on schedule. New York and Massachusetts have seen progress on projects like South Fork Wind, but delays to South Coast Wind and others will make meeting their respective offshore wind targets challenging. In Virginia, Dominion Energy’s Coastal Virginia Offshore Wind (2,600 MW) continues unimpeded, while Maryland’s offshore wind project pipeline faces permitting hurdles.

Developers and States Push Back

Despite the freeze, state leaders and developers remain determined. Dominion Energy confirmed that its flagship project remains on track for 2026, while South Fork Wind continues to generate power for 70,000 New York homes. Governors Phil Murphy (NJ) and Dan McKee (RI) have criticized the freeze, warning of its economic and environmental consequences. Their efforts highlight the growing divide between state-driven clean energy goals and federal policy under the current administration.

EVA’s view: A Temporary Roadblock, but Offshore Wind’s Potential Remains

The federal leasing freeze poses undeniable challenges to the offshore wind sector, but it is far from a fatal blow. Projects that have already secured federal permits and financing remain on track, underscoring the sector’s resilience and the critical role of early approvals in weathering regulatory storms. With strong state commitments and robust private investment continuing to back the industry, offshore wind’s long-term trajectory remains intact as a cornerstone of the U.S. clean energy transition.

That said, the freeze introduces strong headwinds for the U.S.’s previous goal of achieving 30 GW of offshore wind capacity by 2030. Prolonged permitting delays may weaken developer momentum, discourage new investments, and risk creating bottlenecks in the supply chain at a critical time. The clock is ticking for developers to qualify for Inflation Reduction Act (IRA) tax credits, further heightening the stakes.

For a deeper understanding of how these developments impact the renewable energy landscape, explore EVA’s Monthly Renewable Energy Outlook, our comprehensive report on the U.S. renewable energy space. The report offers unparalleled insights into policy, regulatory, and technological trends, helping stakeholders navigate the complexities of clean energy expansion.

To subscribe, request a sample, or for more information, please email us at [email protected]