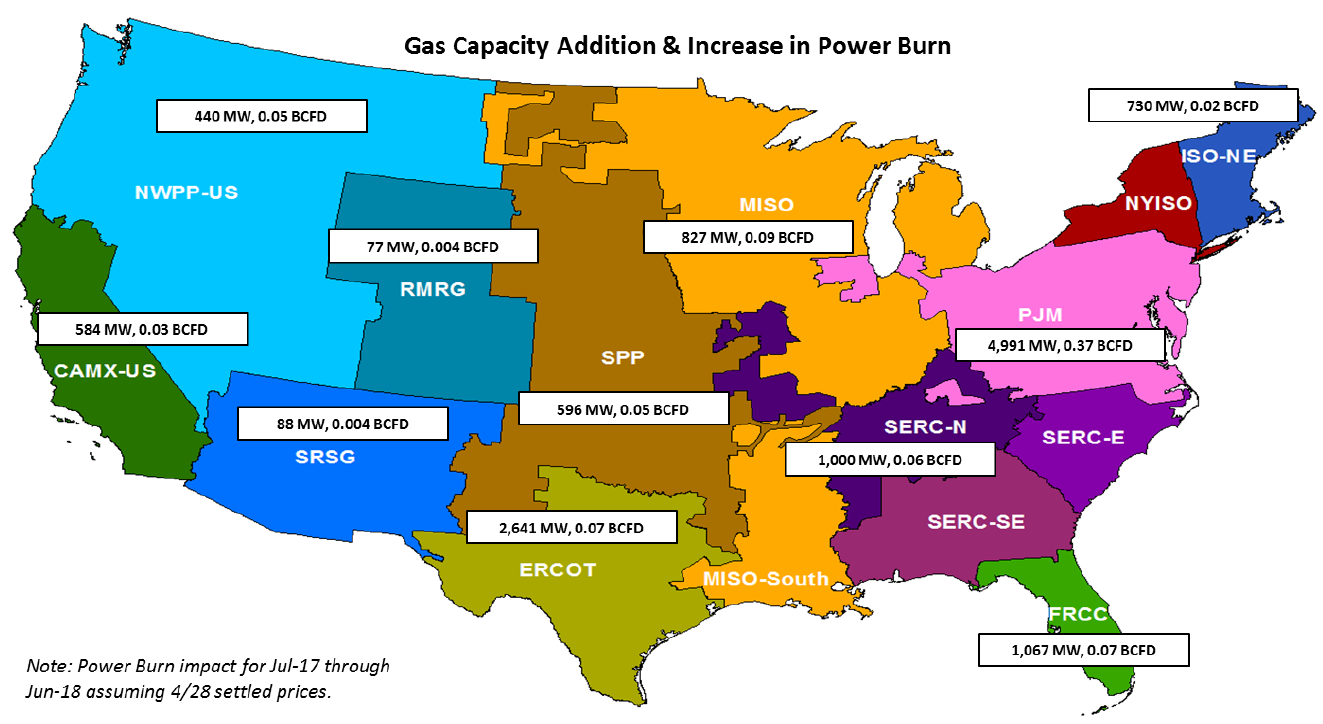

The advent of low natural gas prices as a result of the shale revolution led to a major structural shift from coal to gas in the power markets. Based on EVA’s proprietary Power Plant Tracking Database, almost 47 GW of gas-fired capacity has been added till date starting 2012. Nearly 13 GW of new gas capacity additions took place in the last four quarters across the lower 48, of which 11.7 GW were CCGTs whereas the remaining 1.3 GW were combustion turbines.

The new capacity added over the last four quarters would draw close to 1.5 BCFD of natural gas to produce power. But the overall impact on natural gas demand will be offset by gas-on-gas competition where the new – more efficient units would displace the older- less efficient gas-fired units. EVA projects this impact to be at 0.85 BCFD at current gas prices, but this impact could vary in the range of 0.75 to 1.00 BFCD depending on gas price movement.

Major gas on gas competition can be seen in ERCOT at current gas prices, where the inefficient gas units cannot compete with coal plants burning either cheap PRB coal or mine-mouth lignite, thereby getting displaced by efficient new units. This results in almost 0.22 BCFD of gas burn being offset.

Similarly, in ISO-NE, where very little coal-fired generation exists, new units would displace older gas-fired units especially because the lack of demand growth is unable to absorb the new generation into the supply mix.

PJM and FRCC also experience significant gas on gas competition offsetting nearly 40% of new gas demand.