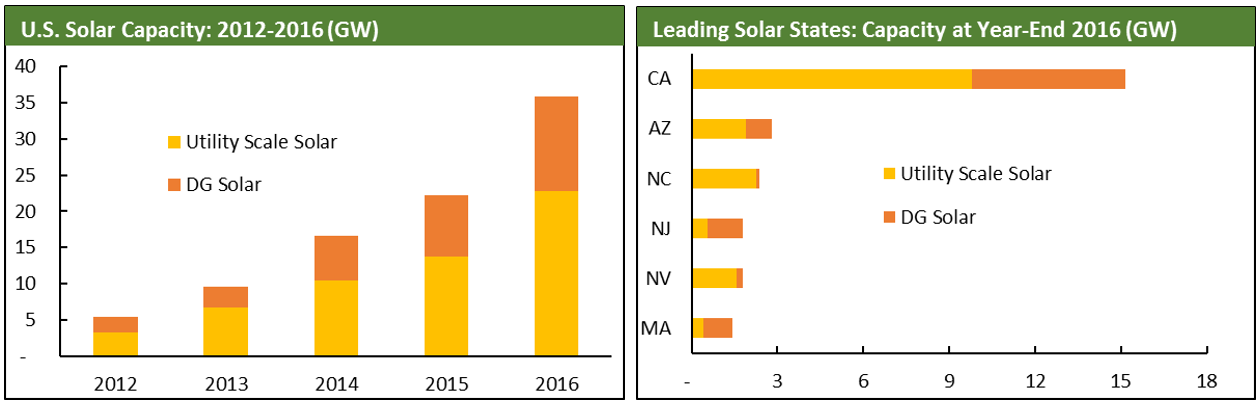

Final numbers from EIA prove what the solar industry had long suspected: 2016 was a record year for solar build in the United States. Driven by plummeting costs and strong policy support in key markets, 13.7 GW of new solar capacity was added in 2016, pushing total U.S capacity to 35.9 GW.

The 13.7 GW of new capacity made solar, by a considerable margin, the largest source of new capacity growth in the U.S., outpacing additions of both natural gas (+9.3 GW) and wind (+8.8 GW). Activity was particularly strong at the end of the year, with nearly 5 GW of solar capacity coming online in Q4 2016. In total, the build represented a 62% YOY growth over 2015.

The bulk of new solar capacity was utility scale solar photovoltaic (PV), which added 9.1 GW of capacity. This was nearly triple the three-year average build of 3.5 GW. There was considerable growth behind-the-meter, as well, with distributed generation (DG, or rooftop) solar PV adding 4.7 GW. There were no new additions of concentrated solar power (CSP, or solar thermal), with capacity holding flat at 1.8 GW.

2016 was destined to be huge for solar due to the previous assumption that the ITC would expire at the end of the year. This concern was rendered moot in December 2015, when the ITC (as well as the PTC) was extended, but already a large tranche of projects had been positioned to come online by the end of the year to take maximum advantage of the credit. In fact, without the extension, even more capacity would have come online in 2016, as some projects subsequently pushed back their start dates to 2017.

In absolute terms, of course, total solar capacity is still dwarfed by wind (82.2 GW), as well as hydro (78.3 GW), gas (442 GW) and coal (265 GW). Further, despite the rapid growth, solar only supplies ~1% of total electricity demand. Average capacity factors for solar hover near 23%, well below those for other technologies.

Solar capacity remains heavily concentrated in a few key markets, though there are considerable geographic differences between utility-scale and DG. The one constant is California. In both segments, it has more than 4xs as much solar as the second leading states. Activity did not slow down in 2016, as the state added 3.3 GW of utility scale capacity and 1.9 GW of DG. Combined, 42% of all U.S. solar capacity is in California. No other state has more than 8%.

On the utility scale side, North Carolina and Nevada both had another strong year, adding more than 800 MW each. More surprisingly, Georgia and Utah also added ~800 MW, increasing their total capacity from to 980 MW and 847 MW, respectively. Perhaps as a sign of things to come, Texas doubled its solar capacity to 579 MW and is expecting rapid growth going forward.

On the other side of the meter, activity outside of California was heavily concentrated in the Northeast and Mid-Atlantic regions. Massachusetts nearly doubled its DG capacity, adding 450 MW, while New Jersey added 430 MW to bring its capacity to 1.3 GW, second behind only California. Maryland (+307 MW), New York (+289 MW) and Connecticut (+110 MW) also had big years.

Having been dominated by California for so long, the Eastward shift of DG installations is notable. With early signs that California is moving towards saturation (though this is highly uncertain), several players in the industry are refocusing their efforts on new markets offering a combination of high power prices, retail net energy metering (NEM), and a robust RPS (including the availability of solar RECs).

Multiple states in the Northeast and Mid-Atlantic check many of those boxes and for that reason will likely continue to see strong growth going forward.

Increased geographic diversity also reflects the considerable strides the industry has made on the cost front. Total installation costs for solar PV have fallen more than 80% since 2009. Overnight costs for new utility-scale solar PV projects have reportedly fallen to $1,500/kW (though these estimates vary widely by region). Costs for DG solar remain significantly higher than large-scale projects, but have fallen below $2,800/kW.

There are early signs that the rate of cost declines may be slowing, but the overall trend remains downward—especially given the global oversupply of low-cost panels coming out of China. The question of how low costs can go, and how quickly they will get there, is the single most pressing uncertainty facing the solar industry today.

Going forward, activity in 2017 is unlikely to match this past year. On the utility-scale side, there is currently only 2.4 GW under construction, including approximately 400 MW in CA, NC and TX. An additional 2.5 GW of capacity has not yet initiated construction, but has announced 2017 start dates. Behind-the-meter capacity additions are far more difficult to project, but activity there is likely to continue at current levels or slow a bit.

In contrast, there is currently 7.2 GW of wind capacity under construction, with an additional 2.9 GW proposed to come online at some point in 2017. EVA also expects 10.1 GW of new gas capacity to come online in 2017.

Construction lengths for solar projects vary, but average 6-9 months, meaning a large portion of the proposed capacity could in fact be completed in 2017. Regardless, even if the capacity does come online, the 2017 utility-scale solar build is likely to total 5-6 GW, below the 9 GW in 2016.