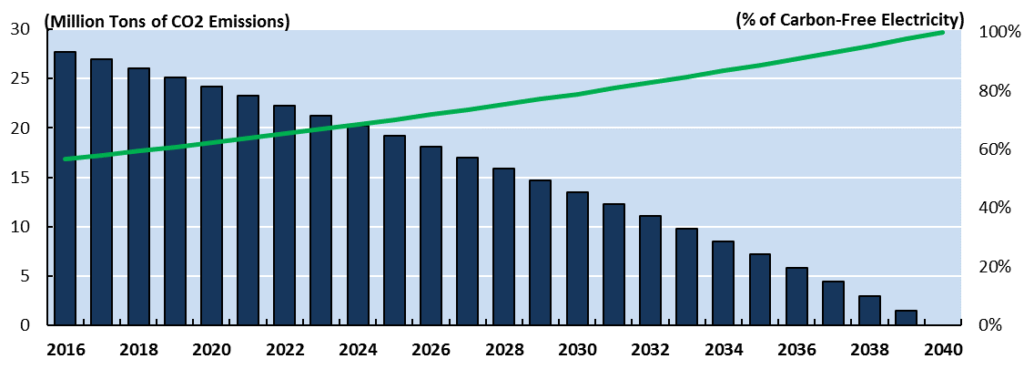

During the summer of 2019 New York State passed the nation’s most stringent energy law in the form of the Climate Leadership and Community Protection Act (“CLCPA”). The law, which EVA analyzed in a recent special report, requires 70% of all electricity sales to be sourced from renewables by 2030, 100% of electricity from carbon-free sources by 2040, and to decarbonize the economy by 2050. In addition to the massive task of decarbonizing the third-largest economy in the United States, the CLCLPA also addresses a wider scope of issues, requiring the state to consider disadvantaged communities and other equality issues as part of New York’s energy future.

EXHIBIT 1 – ELECTRIC GENERATION SUPPLY CONSTRAINTS

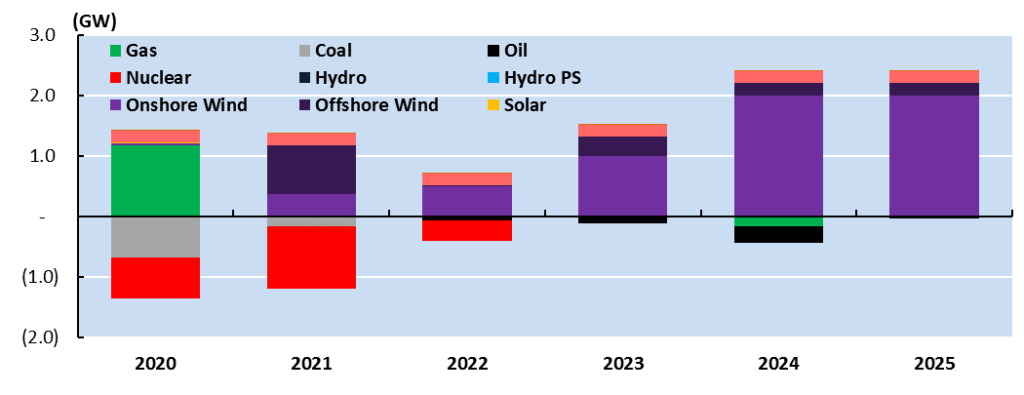

EVA’s modeling suggests that in order to attain these targets, New York must build nearly 5.9 gigawatts (GW) of wind capacity by the end of 2025 (reaching a total of 7.9 GW). Although building onshore wind at a rate of 1 GW per year may not be a logistical problem for the wind industry, New York’s complex legal landscape for siting and permitting likely will require significant reform if the state is to meet its energy goals.

Wind Development and Article 10

Wind capacity development in the New York ISO (NYISO), which administers the state’s wholesale power market, is lagging the rest of the United States. From 2011 to 2019, wind capacity in the continental United States has grown at a compound annual growth rate (CAGR) of roughly 11%. Wind capacity growth in the NYISO market, however, has grown at slightly less than 5% per year over the same period. At the current rate, New York will fall far short of the growth required to meet the requirements of the CLCPA. The state’s permitting process for new power generating facilities is one factor that has slowed down wind project development in the Empire State.

EXHIBIT 2 – Modeled Annual Change in Capacity Mix to Meet Requirements of CLCPA

Siting electric generating facilities (25 MW or greater in size) in New York requires that projects follow a permitting process established by Chapter 388 Article 10 of laws of 2011, which are a subset of the Public Service Laws. Passed in 2011, Article 10 ensures that new projects minimize the impacts of community, economic, cultural, and other externalities. The law gives affected public and other stakeholders a relatively large say in the siting process, even requiring that project developers set aside funding so that communities can commission studies, hire professionals, and fund other activities that allow them to participate in the Article 10 process. Although many stakeholders benefit from this structure, it appears to have an outsized impact on project timelines as private citizens can utilize upwards of hundreds of thousands of dollars of project funding to oppose said project. Ultimately, permitting applications are approved or rejected by the State Energy Siting Board, which consists of five representatives from state agencies and two members from the municipality in which the project is to be sited.

The Article 10 requirements are causing projects to be caught up in a long siting process before construction can even begin. As of November 2019, there are 16 wind projects in the Article 10 queue. At least three other projects have backed out in recent months, citing issues related to the Article 10 process. The current queue contains 16 active projects with a planned cumulative of 3.1 GW of generation capacity. Four projects[1] have gone from the first to the last stage of the Article Ten process. It took an average of 1,350 days for those four projects to progress from the first step of filing a Public Involvement Program (PIP) to final determination by the State Energy Siting Board. If Article 10 activities continue to move at a similar pace, with each process taking an average of more than three and a half years to progress from PIP filing to the end of the Article 10 process, then a project that filed a PIP at the end of this year wouldn’t be ready to break ground on construction until July 2023.

In the case that wind development is delayed to the extent it has been in recent years, achieving the goals laid out under the CLCPA will be extremely difficult. EVA’s modeling suggests that a cost-efficient generation portfolio for New York that also meets the rules of the CLCPA would require onshore wind to produce 15% (17.6 GWh) of the state’s electricity in 2025. New York’s 2 GW of wind capacity is expected to produce 4.4 GWh of electricity in 2019—far below the 17.6 GWh that would meet demand while displacing gas generation.

Solar Development and Article 10

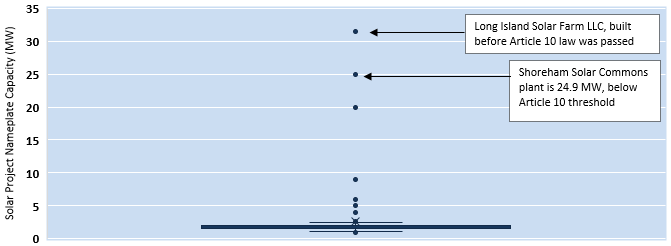

The scale of the potential problem is not restricted to wind projects. The ambition to build large utility-scale solar in New York state is evidenced by the 29 solar projects that are currently in the Article 10 queue. The 29 projects have an average nameplate capacity of 160 MW, with the largest projects boasting up to 350 MW. By contrast, the 310 MW of existing solar capacity in the state is made up of roughly 120 projects with a median nameplate capacity of just 2 MW. Only one project in the entire state is larger than the 25 MW. That project, the 32-MW Long Island Solar Farm, was built before Article 10 was passed into law. The second-largest project, the 24.9 MW Shoreham Solar Commons, commenced operations in 2018 and is just below the 25 MW Article 10 threshold. The size of the Shoreham Solar Commons project indicates that the Article 10 process is likely disincentivizing developers from pursuing large solar projects in the state.

EXHIBIT 3 – Summary of Existing Solar in New York by Project Capacity

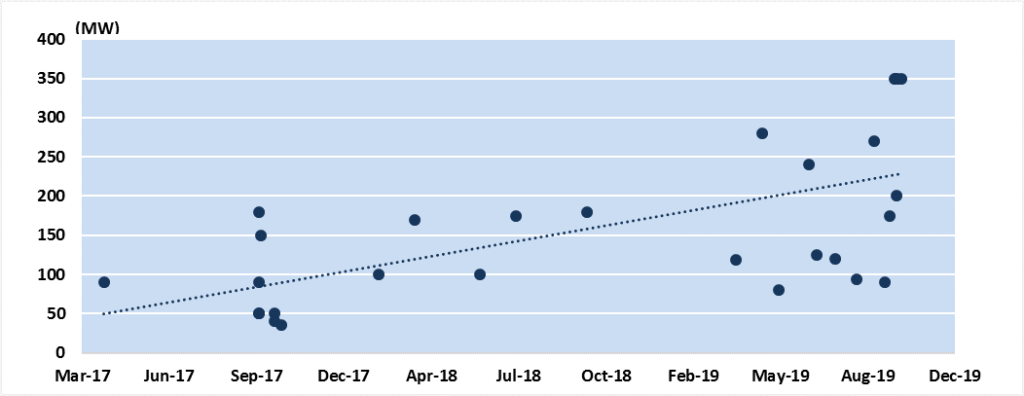

As is the case for wind, the ability for New York to achieve its energy goals heavily relies on the ability for developers to build large solar projects. To date, no solar projects have made it through the process. However, developers are proposing larger and larger projects. Exhibit 4 shows how proposed utility-scale solar projects over the past two years have gradually increased in size, with two 350-MW projects proposed in the last few months.

EXHIBIT 4 – Proposed Project Size by Date of PIP Filing

The success of these projects in navigating Article 10 will have an outsized impact on whether New York can achieve the power sector goals of the CLCPA.

Implications for New York

Barring a major change in the length of the process timeframe or significant legal reform, New York’s Article 10 law for siting large scale energy projects will hamper efforts to reach the state’s ambitious energy goals defined by the CLCPA. Ostensibly, the political will exists to reform Article 10 given how quickly the CLCPA was passed. However, voting to generically increase renewable energy across the state is fundamentally different from voting to make it easier for developers to site large power projects in specific communities. As things stand, the law requires New York to radically increase renewable generation as a percent of total retail sales. If Article 10 is not reformed, investments in energy efficiency, behind the meter generation, and utility-scale projects below the 25 MW threshold could meet a large portion of New York’s demand—albeit at a higher cost. If Article 10 reform does occur, stakeholders should expect a wave of large scale renewable projects in the NYISO market.

[1] Cassadaga Wind Farm (126MW), the Baron Winds Project (242 MW), Eight Point Wind (102 MW), and the Number Three Wind Farm (105.8 MW).