The key premise of OPEC’s plan to balance oil markets was that reduced production, combined with increasing global oil demand, would erode excess supply. While the supply cuts have proceeded largely as planned, global oil demand remains an outstanding question.

Most demand expectations for 2017 were already rather modest, ranging around 1.1 MMBD, or 1.1% per annum—well below the 1.5%, 2.0%, 1.2% and 1.5% per annum growth rates for the prior four years. However, even these low demand expectations are beginning to appear too optimistic, as through early-2017, demand in a few key markets has been disappointing.

Of particular importance is recent data indicating U.S. gasoline demand is actually declining rather than increasing. Given that gasoline is a primary product of each barrel of crude oil, and given the U.S. is the largest gasoline consuming country in the world, this trend by itself is of sufficient magnitude to alter total global oil demand growth in 2017. This will surely hinder OPEC’s efforts by extending the period of global excess supply and in turn, putting continued downward pressure on oil prices.

Falling U.S. Gasoline Demand

The U.S. remains, by far, the world’s largest source of gasoline demand, representing approximately 40% of the global total and nearly 4xs larger than China, the second largest consumer. In fact, U.S. gasoline demand on its own represents nearly 10% of total global oil demand. Thus, slight shifts in U.S. gasoline demand trends can have an outsized impact on global oil market dynamics.

After decades of steadily increasing, U.S. gasoline demand began to decline in 2007, primarily driven by high oil prices and correspondingly high prices at the pump. The ensuing recession, beginning in 2008, as well as persistent high prices, continued to push down U.S. gasoline demand through 2012. By 2013, the trend began to reverse and through 2016, the combination of improving economic conditions and sharply declining oil prices drove U.S. gasoline demand upward. Average annual growth in U.S. gasoline demand from 2013 to 2016 was about 150 MBD, or 1.7%/annum.

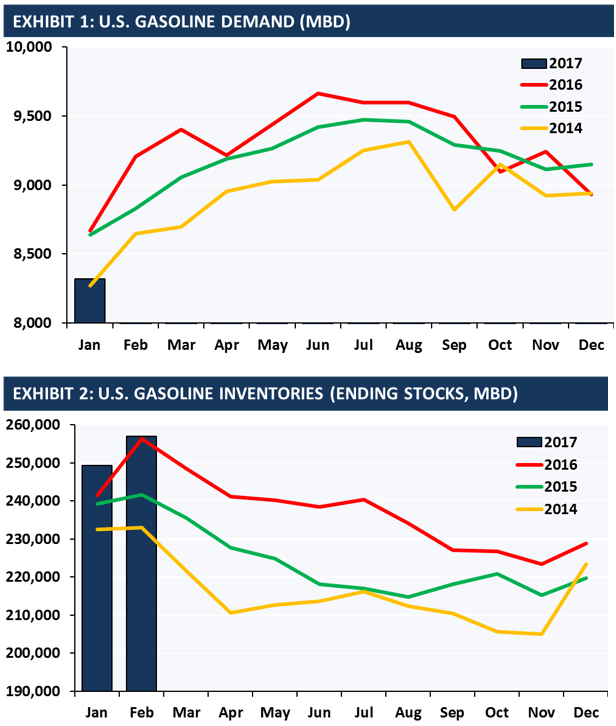

Most market observers expected similar or even higher demand growth in 2017, the result of continual improvement in economic metrics. However, recent EIA data indicates U.S. gasoline demand is in fact declining rather than increasing, as illustrated in Exhibit 1. The reversal in trend appears to have started in 4Q2016. Prior to then, quarterly gasoline demand growth on a YoY basis had been averaging between 1.6 and 2.8%. However, in 4Q2016 gasoline demand declined 0.85%.

This decline was particularly noticeable in mid-winter, when gasoline demand on a YoY basis declined 2.4% in December and 3.7% in January. While the EIA data for January is preliminary, it is supported by weekly third-party surveys of gasoline consumption. In fact, U.S. gasoline consumption in January was the lowest since January 2014.

This decline in consumption has caused U.S. gasoline inventories to surge to record levels, as illustrated in Exhibit 2. In response, U.S. refiners quickly have reduced their utilization rates to 85.4% from 93.6%, indicating there will be a reduction in crude oil purchases in the forthcoming months.

The key factor driving this decline in U.S. gasoline consumption appears to be consumers’ response to higher prices (i.e., price elasticity of demand). Increasing gasoline prices have of course been driven by rising oil prices. Prices have increased 67% since February last year, but through much of 2016 remained below 2015 prices. Thus, while maintaining usual seasonal trends, gasoline demand in 2016 remained well above 2015 demand.

Only towards the end of the year, as OPEC’s production cut took shape, did oil prices, and therefore gasoline prices, begin to make YOY gains.

By mid-February, national average gasoline prices at the pump were almost 33% higher than last year, and are now 16% higher than last year. While the magnitude of the YOY demand declines in December and January is unlikely to be repeated in ensuing months, EVA now expects overall 2017 U.S. gasoline consumption to be flat or even slightly down YOY.

Other Concerns for OPEC

The U.S. is not the only market experiencing unexpected demand shortfalls. In India, Prime Minister Modi’s demonetization policies have sharply reduced oil imports into the country. Combined with sagging U.S gasoline demand, these issues are likely to reduce overall global oil demand growth for 2017. Thus, while OPEC has been somewhat successful in boosting oil prices over the past few months, demand-side dynamics beyond its control are likely to continue undermining the cartel’s efforts going forward.