The PJM powerpool includes several states with sizeable Renewable Portfolio Standards (RPS). The standards—in MD, NJ, OH, PA, IL, DE and DC—require an escalating portion of retail sales be met through qualified renewable energy (RE) generation.

Load serving entities in the PJM region comply with their relevant RPS obligations via Renewable Energy Credits (RECs), which represent 1 MWh of qualifying generation. RECs are tradeable and have varying values depending on the state. Many states have multiple types of RECs, including Tier 1, Tier 2 and solar RECs (or SRECs). Of these, SRECs and Tier 1 RECs are the most valuable.

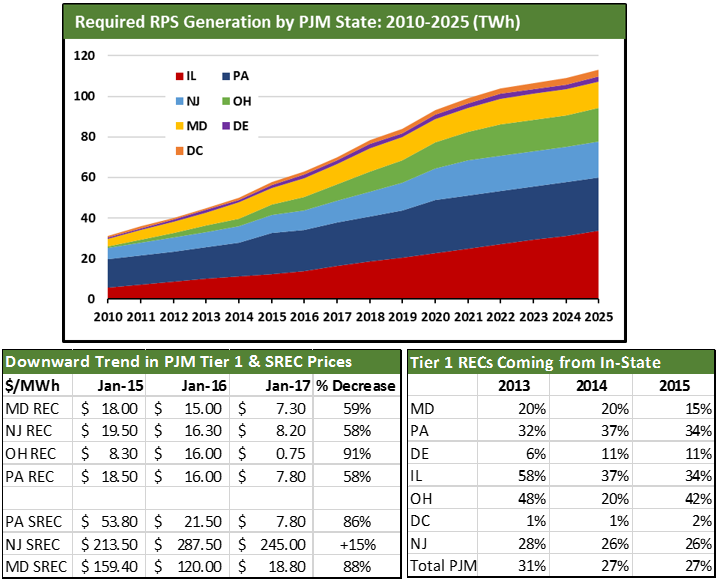

Despite the continuing escalation of the state-level programs (see graph on next page), the region’s cumulative RPS demand has not kept pace with the amount of qualifying RE generation available in PJM. Because RE generation in the region has outstripped REC demand, REC prices across PJM have plummeted in the past few years (see table on next page), with most states settling to multi-year lows.

Notably, the oversupplied PJM REC markets are not chiefly the result of new in-state RE capacity, but are instead driven by the widespread availability of low-cost RECs from PJM states without RPS programs, including VA, WV and IN, as well as states outside of PJM entirely.

Further, many RPS states in PJM allow a large chunk of compliance to be sourced from non-traditional qualifying sources (often designated as “Tier 2” sources) including black liquor, waste coal and municipal solid waste (MSW). While wind comprises the largest share of REC compliance (47% across PJM), 18 different technologies/resources can be used in some manner to comply with various PJM RPS objectives.

Though rarely discussed, the combination of these flexible compliance measures has greatly eased program implementation for load serving entities but has also blunted the growth of RE capacity actually located in-state.

MD, which has one of the PJM region’s most aggressive RE goals, provides a clear example of the considerable range of compliance options allowed under many RPS programs. MD’s RPS began in 2005. It first called for 20% RE generation by 2022, but this target was increased in February 2017 to 25% by 2020. State legislators pushing the bill touted the expected environmental gains, but were particularly focused on the in-state economic benefits associated with the RPS, including the creation of new RE jobs in MD.

On its face, the aggressive RPS would indeed be expected to translate into a rather large investment in new RE capacity in MD. Yet, as of early 2017, MD hosts only 136 MW on utility-scale solar and 190 MW of wind capacity. In fact, during 2016, when MD REC and SREC prices fell by more than 50%, no new wind capacity and only 65 MW of new utility solar was added in the state.

The collapse in MD REC prices then, has little to do with rising RE generation in MD. As the table below shows, in 2015 (the latest year for which full data is available) only 15% of the Tier 1 RECs retired in MD actually came from MD. Instead, the largest source of RECs by far was VA (30%), the vast majority of which were sourced from pulp and paper mills using black liquor to fire their operations. Based on the design of the MD RPS program, VA black liquor is a qualified source of RE generation.

MD load serving entities also sourced a large number of RECs from hydro in NY and wind in IL, as well as two large in-state MSW facilities. MD’s solar carve-out is met almost entirely via in-state purchases, but is associated with distributed generation solar (DG, or rooftop PV) as opposed to utility scale.

MD is far from alone in its reliance on out-of-state RPS compliance. It is of little surprise that states with limited land area, namely DE and DC, must look out of state for compliance, but even PA, OH and IL have in-state compliance rates well below 50%. Across the region, only 27% of overall compliance came from in-state sources. RECs are sourced from 23 other states; the majority of out-of-state RECs are purchased from adjacent PJM states (IN, VA, WV), but a small portion came from as far away as TX and LA.

The combined PJM REC oversupply and corresponding low prices are likely to persist through 2017 and 2018. However, for many of the qualifying sources (e.g., black liquor, biomass, MSW, among others) little new capacity is expected to be added. This in turn will force PJM states to meet rising RPS requirements with new capacity (most likely wind and solar). Yet based on current proposals, there does not appear to be enough capacity coming online in PJM to maintain current REC surpluses. For that reason, EVA forecasts PJM REC prices to increase beginning in 2018 and beyond.